Launching new products for financial health in Kenya, Mexico & Philippines

Validating & designing new products to serve the global majority

Tala is a microfinance and data company expanding financial health with globally underbanked communities. In a context where 60-70% of the world’s population lacks access to financial services — from savings, to credit, to remittances — our mission as a company centers around expanding financial health for the global majority.

Across 2019-2020, I served as the product lead for new products across Kenya, the Philippines, and Mexico resulting in launches for savings, debit cards, insurance, financial education & coaching, and 0% interest loans for essential community services during COVID-19. I guided cross-functional teams and led product strategy, research and design, partnerships, technical and regulatory diligence, and program management to incubate and launch products that better served our customers and our mission.

Project Snapshot

Kenya, Mexico, Philippines

2019-2020

In partnership with: Tala

Project category: design research, product & business strategy

Role: Product Lead

Savings x Financial Health: Product Discovery

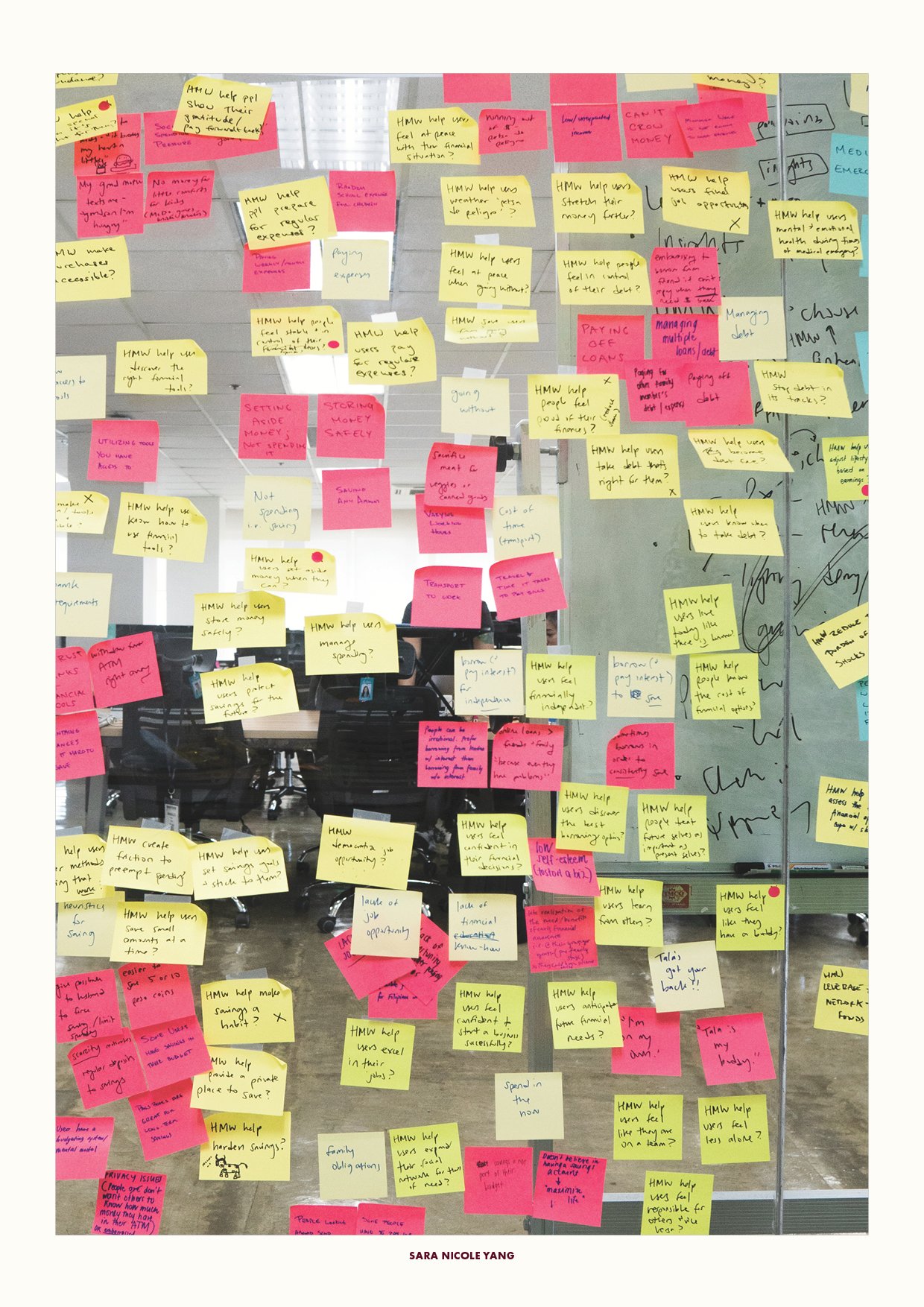

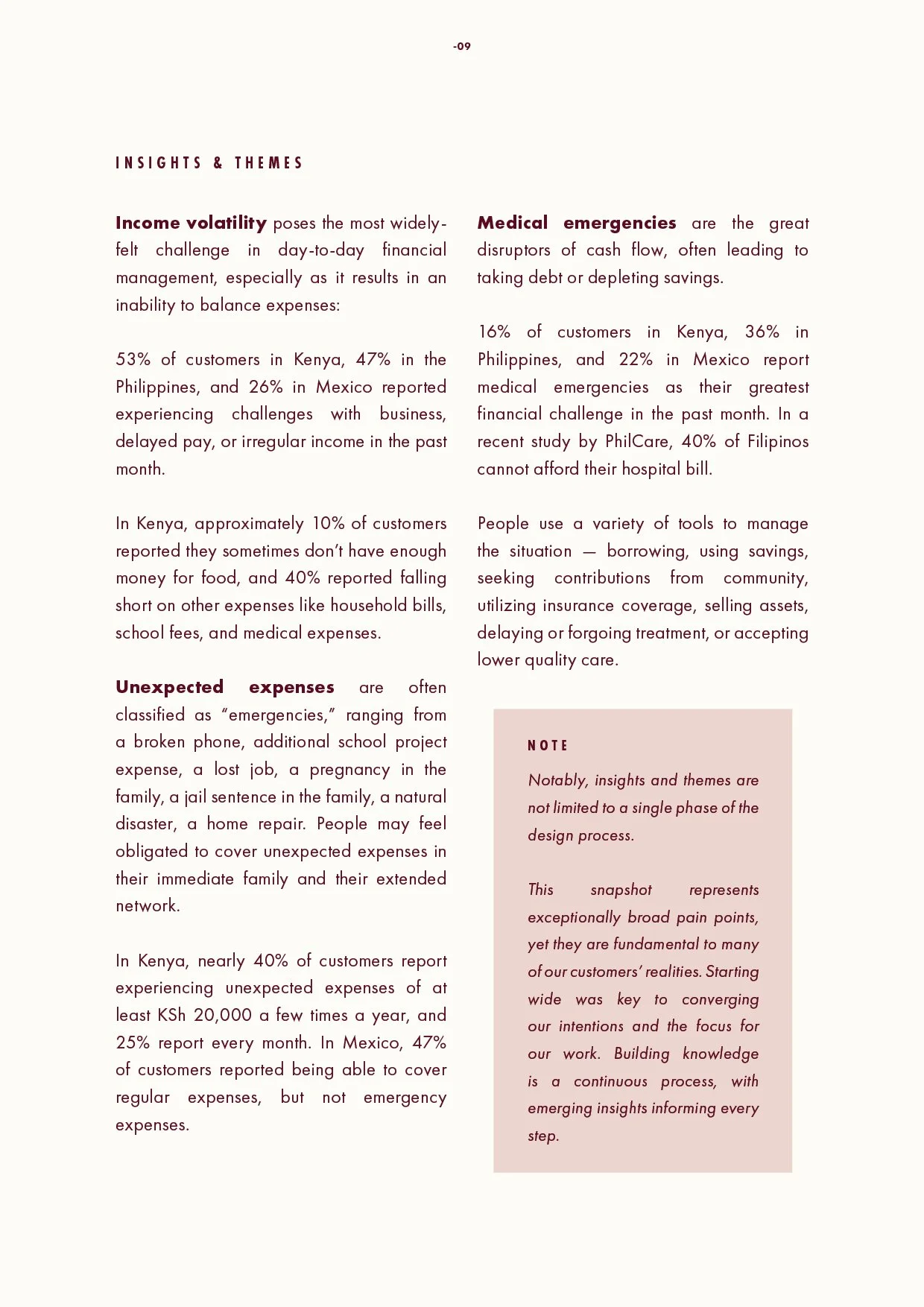

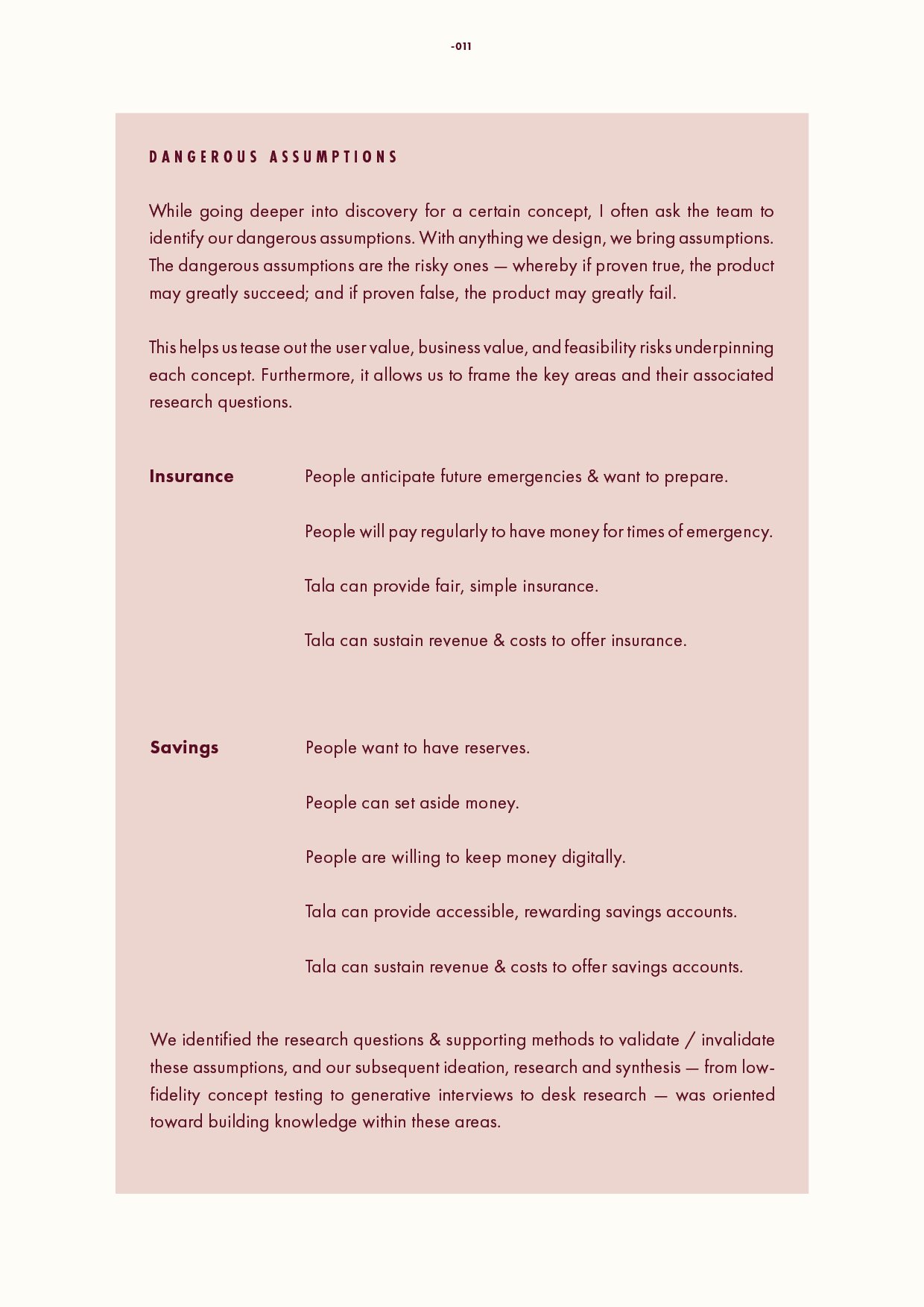

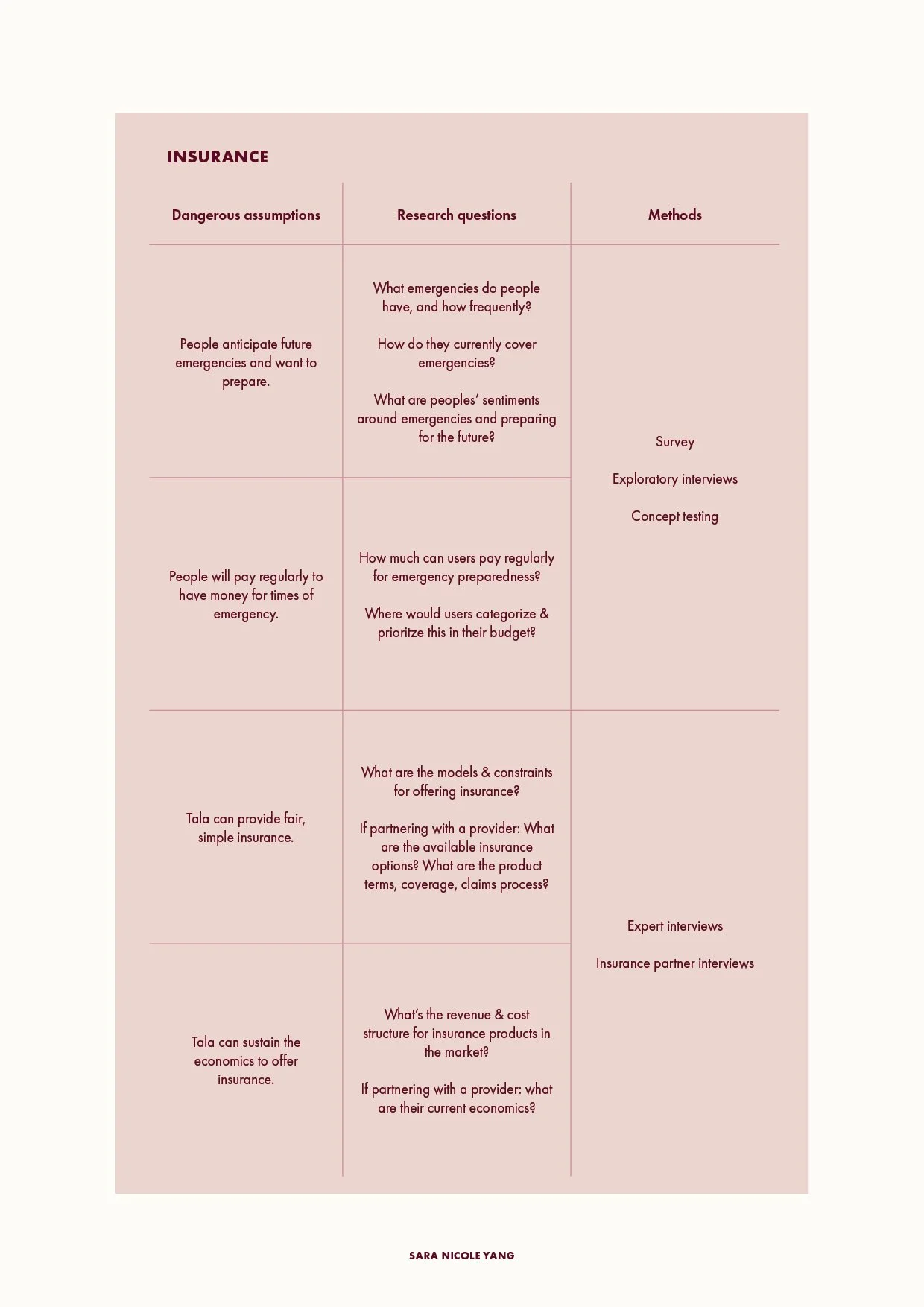

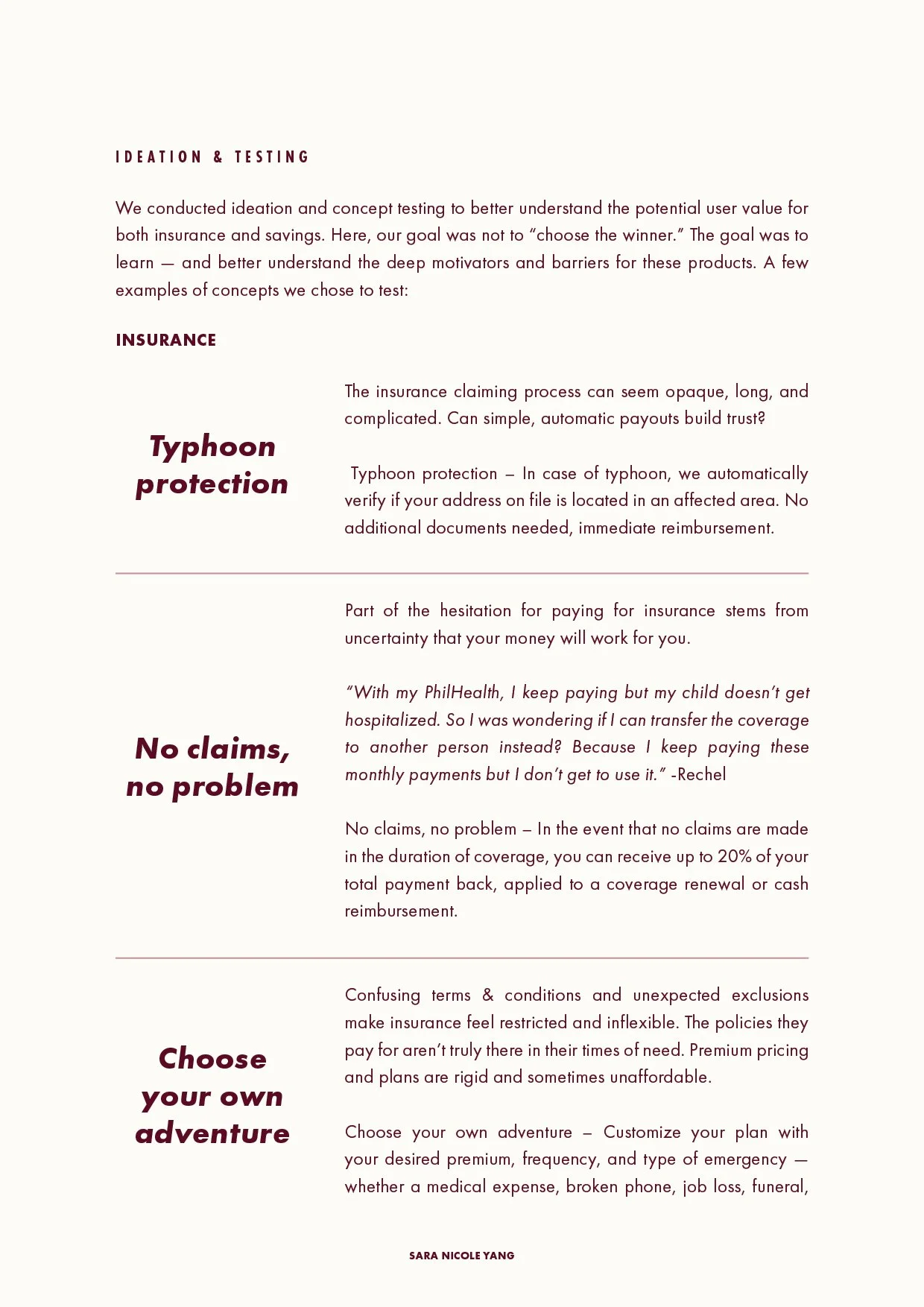

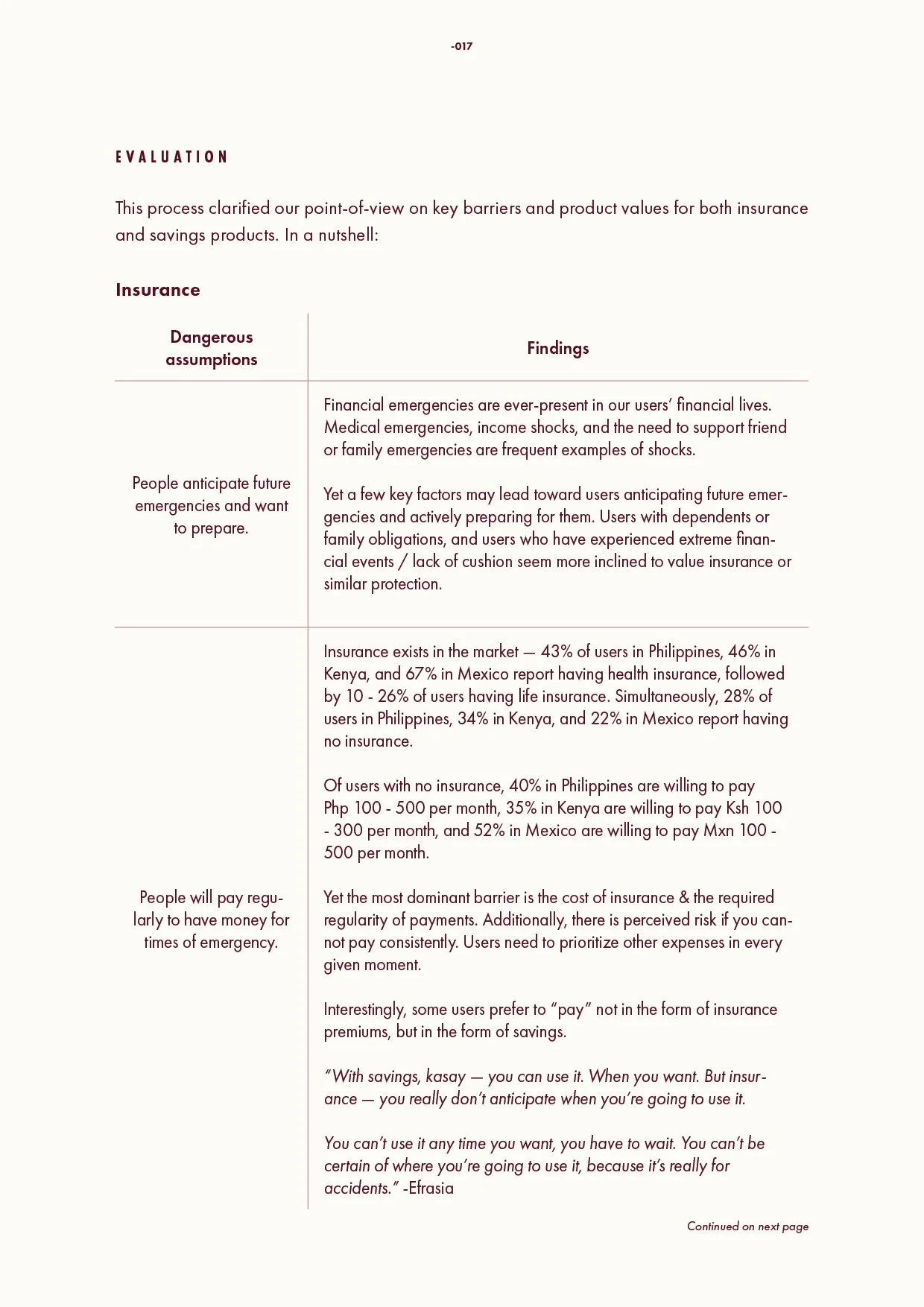

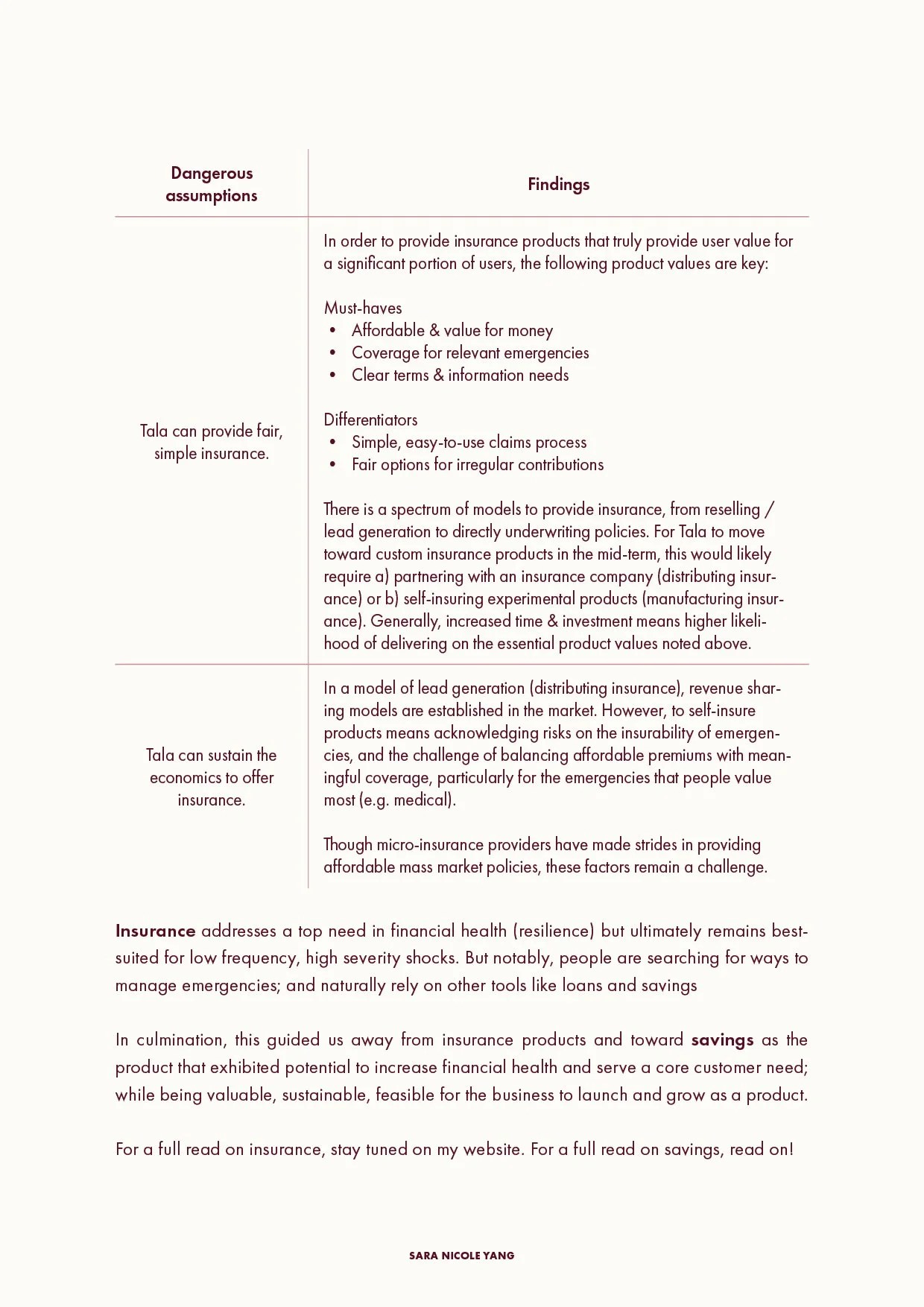

In 2019, I was asked to create and lead a new product squad to validate a new, global product in one quarter. Over the course of two months and three countries, we interviewed over 70 customers, tested over 30 concepts, ran demand & pricing tests, and engaged with multiple partners to develop our strategy for a savings product.

Read the research report: understanding savings motivations & behavior, for a product that uniquely serves our customers’ needs.

For more context: Get a walk-through of our research & product discovery process, designing toward financial health.

Note: All documents are for supplemental review, and not for distribution.